Money matters: Financial Planning Academy teaches campers life skills

Until last week, the University of Georgia was never on Griffyn Taylor’s radar.

An accomplished student at South Plantation High School near Fort Lauderdale, Fla., Taylor arrived on campus fresh from a three-week drama camp in New York City to attend the Financial Planning Academy camp, hosted by the College of Family and Consumer Sciences.

“I felt like it would give me a better background on finances because I’m not a math person,” Taylor said. “I wanted to see if there were other outlets where I could grasp knowledge. I felt like starting that financial plan now, getting into that undergraduate year, will definitely help me in the long run.”

Funded by the Charles Schwab Foundation, the camp is designed to introduce high school students to personal financial planning and increase their financial literacy.

Directed by Kimberly Watkins, a faculty member in the FACS department of financial planning, housing and consumer economics, with help from financial planning students and professional volunteers, the camp has grown every year since its inception.

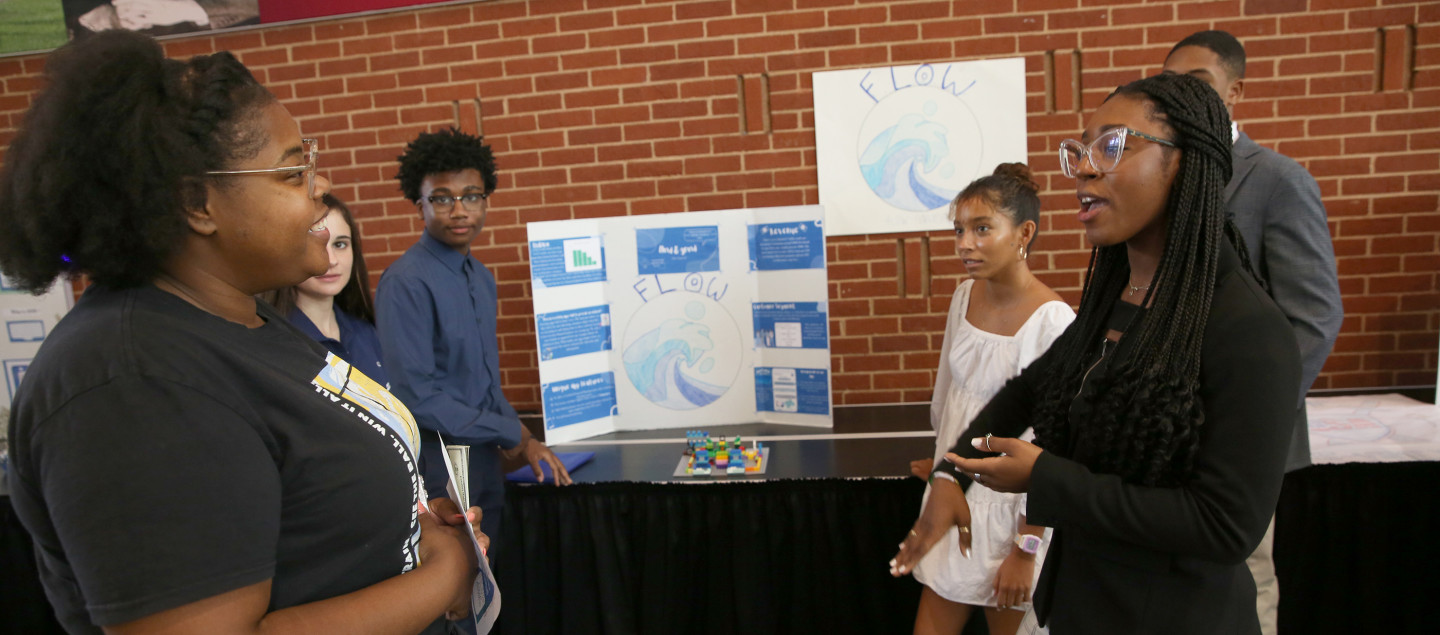

Students spend the week working on a financial planning case study, creating a social media page for a fictional financial planning firm and designing an app to promote financial education and financial planning to young people.

The weeklong camp ends with group presentations where guests are given $2,000 in “investment bucks” to invest in a group’s app. Winners are announced following the presentations.

For camper Aakash Joshi, a rising sophomore at Chattahoochee High School in Alpharetta, the camp help demystify some of the issues contributing to low financial literacy rates among young people.

“Money in society today is kind of a taboo subject,” he said. “A lot of people don’t discuss their finances, so it makes it really hard to get information on how to properly manage them. Programs like this help out and give you experiences and teach you how to manage your finances.”

Camp instructor Benjamin Hampton, a doctoral student in the FACS financial planning program, said the 41 campers made great strides during the week.

“The most gratifying part for me has been seeing the light bulb go off in so many students," he said. “A few of them said they really didn’t have any idea what financial planning was before this camp, and now they know a lot. I think they’ve also learned there are many different career paths within financial planning."

Joshi said the camp opened his eyes to a variety of subject and careers related to the field. While he plans to pursue a career in industrial engineering, Joshi said the camp has convinced him to take a financial planning course in college.

“I learned estate planning, medical power of attorney, financial power of attorney like (handling) wills, all the types of insurance,” he said. “And that it’s really important to invest in a 401k early. I’m definitely going to use it to plan my own finances.”

Taylor said she found the case study particularly useful. Her team of five was tasked with coming up with a four-year financial plan for a fictional couple experiencing financial trouble that included significant student loan debt.

“I felt intimidated by the case study because finances aren’t my strong suit, but the mentors came in and explained it and it all made more sense,” she said. “I honestly would not have been able to present a lot of the case study without the mentors who sat down and took the time to talk with us. The collaboration was so helpful.”

Taylor has college drama auditions later this summer and said she still plans to pursue a master’s degree in musical theater, but her experience at the camp convinced her to add UGA to her list of prospective colleges.

She’s also more intrigued by financial planning.

“I’d also advise other students and people my age to look into it,” she said.

In this category: Finance

-

Estate planning workshop aims to bridge knowledge gap for Georgians

Free workshop features attorney presentations to help residents protect assets

-

Expert tips to avoid overspending on clothes

Faculty member Michelle Kruger offers some insight to consumers considering a wardrobe upgrade

-

Hargrove named assistant director of UGA Love and Money Center

Licensed marriage and family therapist will teach graduate-level courses and lead outreach efforts

-

Organize your expenses better with these expert tips

Faculty member John Grable answers some common questions related to budgeting

-

From childhood sleuth to financial well-being expert

Watkins uses real-life examples to understand money issues in relationships